🤖What AI App Users Really Want?

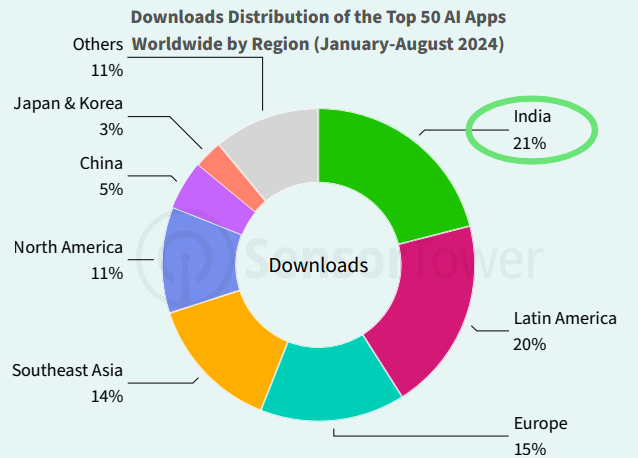

India is the largest market for AI app downloads, accounting for a significant 21% of the global total in 2024. This translates to an astounding 462 million downloads!

What AI App Users Really Want?

Indian users are a paradox. According to a latest report on AI app downloads and revenue, India has cemented itself as a leader in AI app adoption, contributing a staggering 21% of global downloads in 2024.

But here’s the catch: while Indians are fervently downloading AI apps, they’re spending far less than their counterparts in the U.S. or Europe.

Before we dive in, let’s look at some stats from the report

The report by Sensor Tower says that the number of AI app downloads exceeded 2.2 billion worldwide between January and August 2024. This figure is projected to surpass 3.3 billion by the end of the year, with an impressive 26% YoY growth.

The financial side is just as remarkable, with in-app purchase (IAP) revenue from AI apps topped $2 billion in the first eight months of 2024. This revenue is projected to climb to $3.3 billion by December, with a strong 51% YoY growth.

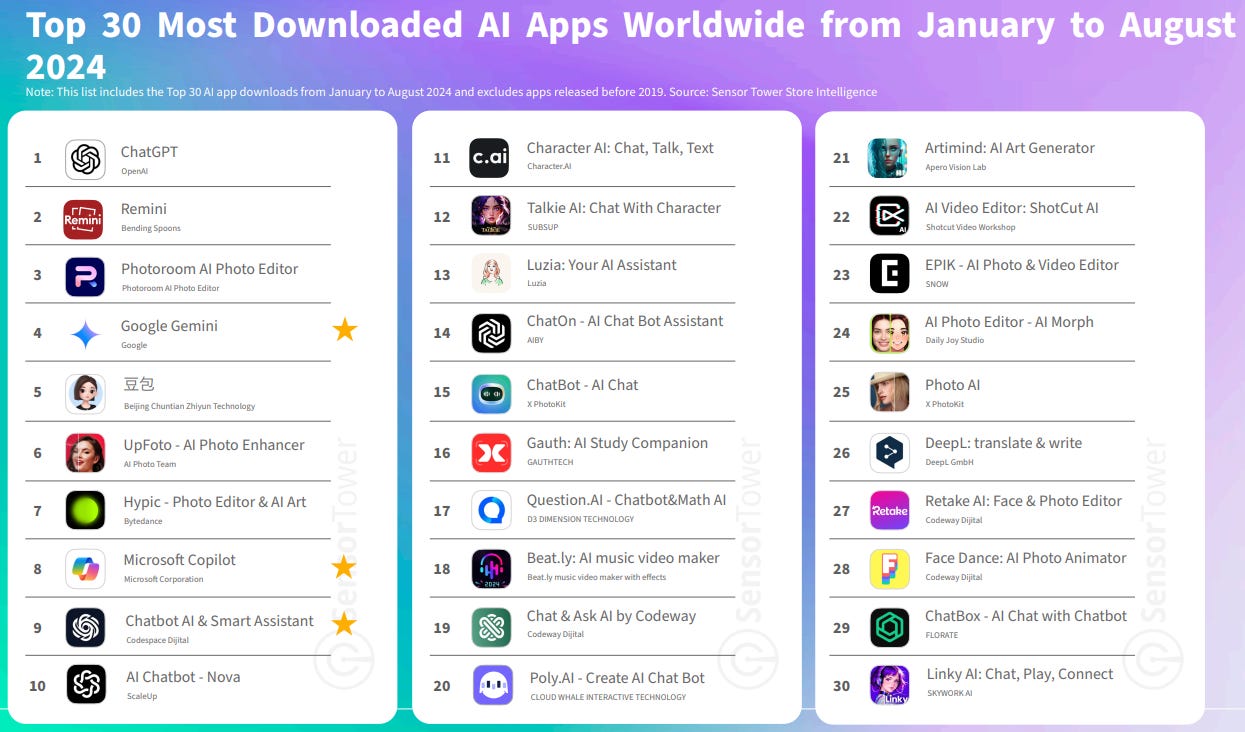

The world’s most downloaded AI apps in 2024 (according to the report) are Chatgpt, Rremini, Photoroom AI photo editor, Google Gemini and Doubao (ByteDance’s AI smart assistant).

Point to note: India, boasting the highest number of social media users globally, accounted for 36% of the total downloads of AI Art Generator apps, while the US accounted for 43% of the total IAP revenue during the first eight months of 2024.

What’s noteworthy is that among the top 30 most downloaded AI apps globally, the majority are either chatbots or photo/video editors. This trend indicates a growing interest among users, particularly those under 50, in tools that enhance communication and creativity.

Why it matters - A detour into AI photo/video editors

For years tech companies have been showing off tools that use AI to create short video clips or to generate and edit photos. But now, major players in this segment have started to take notice and we are going to see an intense “app war” here soon.

Case in point, Adobe, released a public beta of its Firefly Video Model this week, allowing its Creative Cloud subscribers to turn ideas and photos into short video clips. Adobe also added a Generative Extend feature to a beta version of Premiere Pro that uses generative AI to lengthen footage that has been captured.

Meta too recently unveiled Video Gen, a more powerful AI engine, with an aim of bringing it to customers by next year. Earlier this year, OpenAI's demo of its Sora video making tool wowed almost everyone and last month Google too added AI tools based on its Veo model to YouTube Shorts.

As video turns into the next big frontier in AI content creation, the industry is racing into a new competitive brawl over capabilities and speed!

But I think the biggest impact would come if Apple and Google included this technology in the default Android or iOS cameras — since that's where the majority of photos are taken.

Coming back to the Indian AI Paradox: Enthusiastic Downloads, Tepid Spending

India's tech-savvy users propelled the country to the top of the AI app download charts with 462 million downloads, far outpacing regions like North America and Europe.

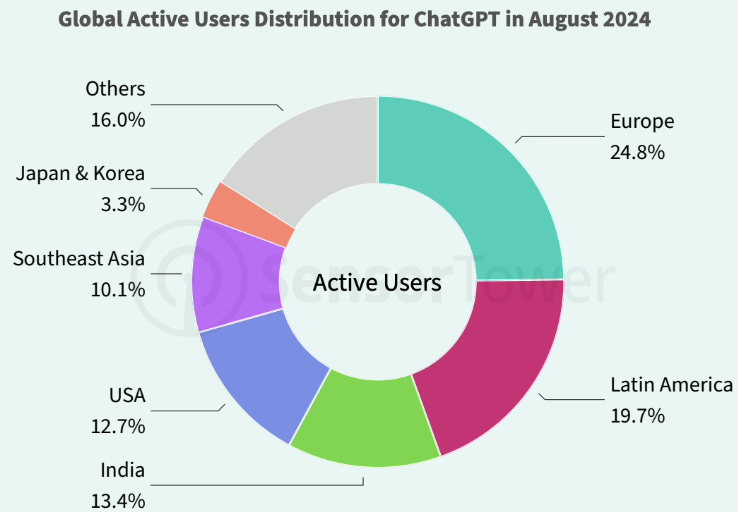

AI chatbot apps, in particular, have experienced unprecedented growth over the past year, largely driven by the popularity of ChatGPT. Speaking of dominance, ChatGPT’s monthly active users (MAU) have steadily risen, reaching over 190 million in August 2024, placing it ahead of all other AI apps globally.

Notably, India ranks as the third market for ChatGPT by MAUs, representing 13.4% of its global user base. The top two markets – Europe and Latin America – accounted for 24.8% and 19.7% of global active users, respectively.

Yet, despite this massive user base for AI apps, especially chatbots, India is not even in the top six revenue-generating markets for AI apps. In stark contrast, North America, contributing just 11% of downloads, generated nearly half (47%) of the global AI app revenue.

What’s happening here?

The crux of the matter is the profound price sensitivity of the Indian market. Indian users, though enthusiastic about technology, overwhelmingly seek out free or low-cost solutions. The reluctance to spend on premium AI features isn’t just a quirk of the AI app market—it’s a broader reflection of consumer habits in the digital economy.

While users flock to these apps for their novelty and utility, the moment monetization kicks in, the vast majority churn or find free alternatives.

The question for product founders and leaders becomes: Can free AI apps succeed long-term in India, or will companies have to rethink their business models?

What Does This Mean for Product Builders?

Volume vs. Value:

India’s sheer volume of users makes it a crucial market, but product strategies need to adjust to the lower spending potential. Revenue models that work in North America won’t necessarily succeed here.Ad-Supported AI Models:

If in-app purchases aren’t clicking with Indian users, perhaps ad-supported or sponsored content can help AI apps turn engagement into revenue. Much like the OTT sector, AI app developers might need to explore non-traditional monetization strategies to unlock value.The Subscription Trap:

Indian users have shown a strong aversion to subscription models—especially when it comes to AI-powered services. This should prompt product leaders to rethink how they structure subscriptions.Leverage Partnerships and Bundles:

Subscriptions don’t work well in India for most digital services unless they’re bundled with other offerings. Telecom companies like Jio and Airtel have seen success by offering content streaming services as part of their mobile plans. AI apps could explore partnerships with telecoms or digital payment platforms, providing premium features as part of a larger service bundle, which could lower perceived costs and drive adoption without users feeling they are overpaying.Microtransactions: Learning from Fintech and E-commerce

Another aspect unique to India’s digital economy is the success of microtransactions and "sachet pricing" across various sectors like fintech and e-commerce. Indian users are more likely to pay for bite-sized, affordable services rather than large upfront costs or recurring payments. AI apps that offer micro-purchases—such as one-time feature unlocks or pay-per-use models—may find greater success here.Catering to the World's Largest Mobile Market:

India’s digital ecosystem is highly mobile-driven, with most users accessing apps via smartphones rather than desktops. AI apps should focus on mobile-first designs optimized for lower-end devices and data-light functionality. As seen in the success of apps like TikTok and its Indian counterparts, data-saving features and offline capabilities can go a long way in building sustained engagement among Indian users who may have limited data plans or intermittent connectivity.

The Bigger Picture: Does India Signal a Global Trend?

Product leaders should take note—users love AI, but not all of them are willing to pay for it. The Indian market might force a shift in how we think about AI-driven products. Is there a future where the true value of AI is unlocked not through direct payments but through decentralized, ad-based, or even collaborative models?

Moreover, building AI apps for India requires more than just scaling a global model. To succeed, product leaders must adjust to the unique behaviors and cultural nuances of the Indian consumer, where affordability, mobile-first design, and free or ad-supported models dominate the landscape.

Adaptability, regionalization, and innovative monetization strategies will define which AI apps thrive in this complex and dynamic market.

You might also be interested in this Stanford Webinar

Identifying AI Opportunities: Strategies for Market Success

In this video, Aditya Challapally (Stanford Online instructor, machine learning expert, and product manager) debunks myths and shares what truly works with Generative AI, backed by insights from over 300 users and 50+ executives.

He argues that we are currently in the same stage with AI/Gen as we were with the internet, and those who seize the opportunities will disrupt and replace companies that fail to adapt. He emphasizes that even small efforts in AI can lead to significant career growth and advancement for non-technical professionals, such as product managers and business analysts.

In this practical, data-driven webinar, you will:

Uncover the truth behind common AI misconceptions

Learn how industry leaders are setting the standard for AI innovation

Explore the most promising AI opportunities on the horizon

📬I hope you enjoyed this week's curated stories and resources. Check your inbox again next week, or read previous editions of this newsletter for more insights. To get instant updates, connect with me on LinkedIn.

Cheers!

Khuze Siam

Founder: Siam Computing & ProdWrks