Why ONDC Isn't Disrupting Like UPI (Yet)

This Week in Products, we explore the curious case of ONDC. Touted as the next UPI moment, the platform fails to create impact despite govt's projected numbers.

When the Open Network for Digital Commerce (ONDC) launched in 2021, it was hailed as the next big disruption in India's digital ecosystem, comparable to the revolutionary impact of UPI on payments.

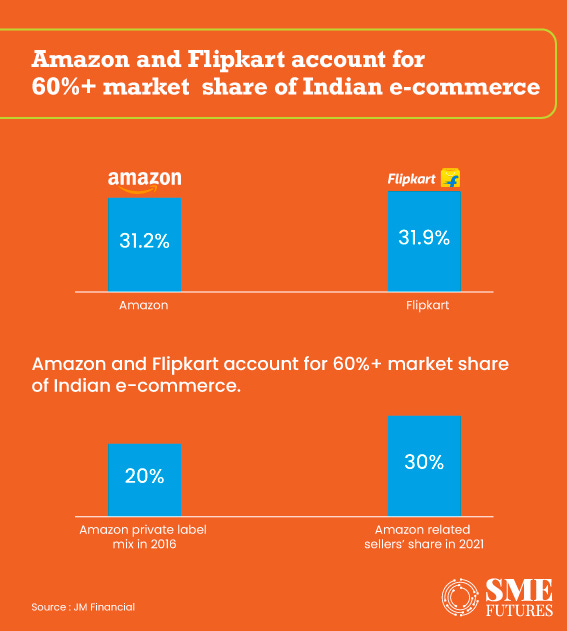

The promise was enticing: an open and inclusive e-commerce marketplace that could break the monopoly of giants like Amazon, Flipkart, Swiggy, and Zomato while empowering small businesses.

Recently, Commerce Minister Piyush Goyal shared statistics celebrating ONDC’s achievements, on account of the platform turning 3:

However, a closer look at adoption trends, business sustainability, and real user stories tells a different tale. A recent Economic Times article I read raises serious questions about whether ONDC is truly disrupting the market or if its impact has been overstated.

If ONDC is to truly disrupt e-commerce, it needs more than policy backing—it needs to solve core product problems.

The Struggle to Define ONDC’s Value Proposition

Despite onboarding sellers and enabling transactions, ONDC is struggling with a fundamental product question: Why should consumers buy here instead of Amazon or Flipkart?

A network participant (NP) quoted in Economic Times summed up the dilemma:

“We’re still not able to answer why you would buy a product on ONDC rather than Amazon or Flipkart. The argument of it being cheaper doesn’t hold good anymore—it’s the same price everywhere.”

This highlights a fundamental issue: while UPI disrupted the payment landscape by eliminating transaction fees and making digital payments universally accessible, ONDC has not provided a clear enough advantage over existing e-commerce giants.

Demand Gen & Financial Sustainability - Weak Spots

Another concern raised by NPs is that unlike Flipkart and Amazon, which invest heavily in demand generation, ONDC’s buyer apps aren’t driving organic traffic. ONDC’s demand generation remains weak.

“Other than Ola and Namma Yatri, nobody has been successful in demand generation.”

This means that while sellers are joining ONDC, customers are not necessarily flocking to the platform, leading to stagnation in order volumes.

Growth metrics reflect this stagnation:

ONDC saw strong MoM growth in mid-2023 (May: 35.5%, June: 10.34%, July: 20.26%)

By late 2023, growth slowed to single digits (November: 3%, December: 6.9%

Many NPs also struggle with profitability. While ONDC’s commission fees are lower than traditional platforms (5% buyer-side, 2% seller-side), the lack of scale makes profitability difficult.

Sellers have reportedly cut staff dedicated to ONDC transactions, signaling that the platform isn’t generating enough business to sustain operations.

This leaves the buyer apps stranded and burning money to acquire customers. Taking cognizance, ONDC delayed imposing a network fee due to seller concerns. If sellers and network participants cannot sustain their operations, the long-term viability of ONDC is in question.

What founders should note:

ONDC’s marketplace model assumes that once supply is in place, demand will follow. But that’s not how successful marketplaces scale.

Demand-first approach: Successful platforms create demand before scaling supply. Amazon invested billions in Prime memberships to lock in repeat purchases.

Strong buyer-side incentives: UPI used cashback, instant payments, and zero MDR to drive adoption. ONDC lacks a similar buyer pull.

Better UX and trust: Consumers don’t just buy on Amazon for pricing; they trust it for fulfillment, reliability, and customer service. ONDC apps need to match this experience.

The Google-UPI Factor: What ONDC is Missing

A fascinating discussion about GPay on The Ken’s Two by Two podcast sheds light on what ONDC might be lacking. Abhishek Madan, VP of Product at Paytm, recalled how Google’s early adoption of UPI gave it instant credibility and traction:

“If you were an NPCI product manager in 2017 and Google said, ‘I will build on your rail,’ you would be the happiest person on Earth.”

Abhishek believes Google’s heft and allure as an international tech giant was welcomed by the National Payments Corporation of India (which was rolling out UPI at the time) because it granted the project an enormous amount of legitimacy.

Where is the equivalent of a Google or Paytm for ONDC?

Even major Indian platforms like IRCTC and BookMyShow haven’t integrated with ONDC, keeping their distribution exclusive. For ONDC to scale, it needs an industry giant to champion it.

Where ONDC Works: Food & Mobility

Despite its challenges, ONDC has made meaningful inroads in two sectors:

Mobility: Namma Yatri’s success and Ola’s recent entry show strong traction.

Food delivery: Magic Pin—India’s 3rd largest food app —has leveraged ONDC effectively, offering an alternative to Swiggy and Zomato.

Moreover, small businesses and local vendors—who previously lacked a digital presence—have at least gained a foothold in online commerce.

So, Is ONDC a UPI 2.0 or Overhyped Initiative?

ONDC’s vision is ambitious and unlike anything attempted globally. But after three years, skepticism is mounting. It’s clear that the project needs:

A clear differentiator – Why should users choose ONDC over existing platforms?

Better demand generation – More marketing, better user experience, and stronger buyer apps.

A ‘Google moment’ – A major platform embracing ONDC could change the game.

The real test will be whether it can move from government-backed expansion to genuine market-driven success. Until then, ONDC remains a work in progress—a promising idea still searching for its breakthrough moment.

What do you think? Can ONDC turn the tide, or is it destined to remain a government-driven experiment without true disruption? Let’s discuss.

Bonus: Understanding the $80 billion ONDC opportunity

Another video I enjoyed watching this week

A Guide to Product Strategy

In this video, my favorite podcast host, Lenny Rachitsky interviews Chandra Janakiraman, the chief product officer, executive vice president, and a board member at VRChat. They talk about my favorite subject - product strategy.

The reason why I loved this video is because Chandra shares that product strategy can be developed by anyone with the right approach, breaking the myth that some people need a “strategy gene” to be better.

Watch the video for more insights

📬I hope you enjoyed this week's curated stories and resources. Check your inbox again next week, or read previous editions of this newsletter for more insights. To get instant updates, connect with me on LinkedIn.

Cheers!

Khuze Siam

Founder: Siam Computing & ProdWrks